Defend Your Brand with

Microsoft Fraud Prevention

Dynamics 365 Fraud Protection saves money and improves shopping experiences.

In 2018, retailers reported a combined total loss of $90 billion in fraudulent eCommerce transactions¹. And while online fraud has gotten more sophisticated (and tougher to spot), Microsoft and Sunrise Technologies can help you mitigate the losses from fraud and help you stay profitable. By connecting global transaction data and artificial intelligence, Dynamics 365 Fraud Protection reduces revenue losses, improves bank acceptance rates while reducing false positives, and improves your customers' shopping experience.

¹ LexisNexis® Risk Solutions 2018 True Cost of FraudSM Study Retail Edition

Proven to mitigate fraudulent attacks

After searching for a comparable fraud analysis tool for their own diverse eCommerce business, Microsoft found that most options were expensive and lacked all the functionality needed to truly secure their business. So, Microsoft's own security experts developed Dynamics 365 Fraud Protection, a world-class set of tools that focus on payment fraud protection for eCommerce businesses. Microsoft was able to reduce manual review of fraud activity by 70% and reduced losses by $75M. All while improving the experience for legitimate shoppers and lifting revenue by 9% with fewer false positives and higher bank acceptance rates.

REDUCE EXPENSES

Decrease fraud losses and the cost of manual transaction reviews.

INCREASE REVENUE

DELIGHT CUSTOMERS

Reduce friction and frequency of challenges in the buying process to decrease abandonment.

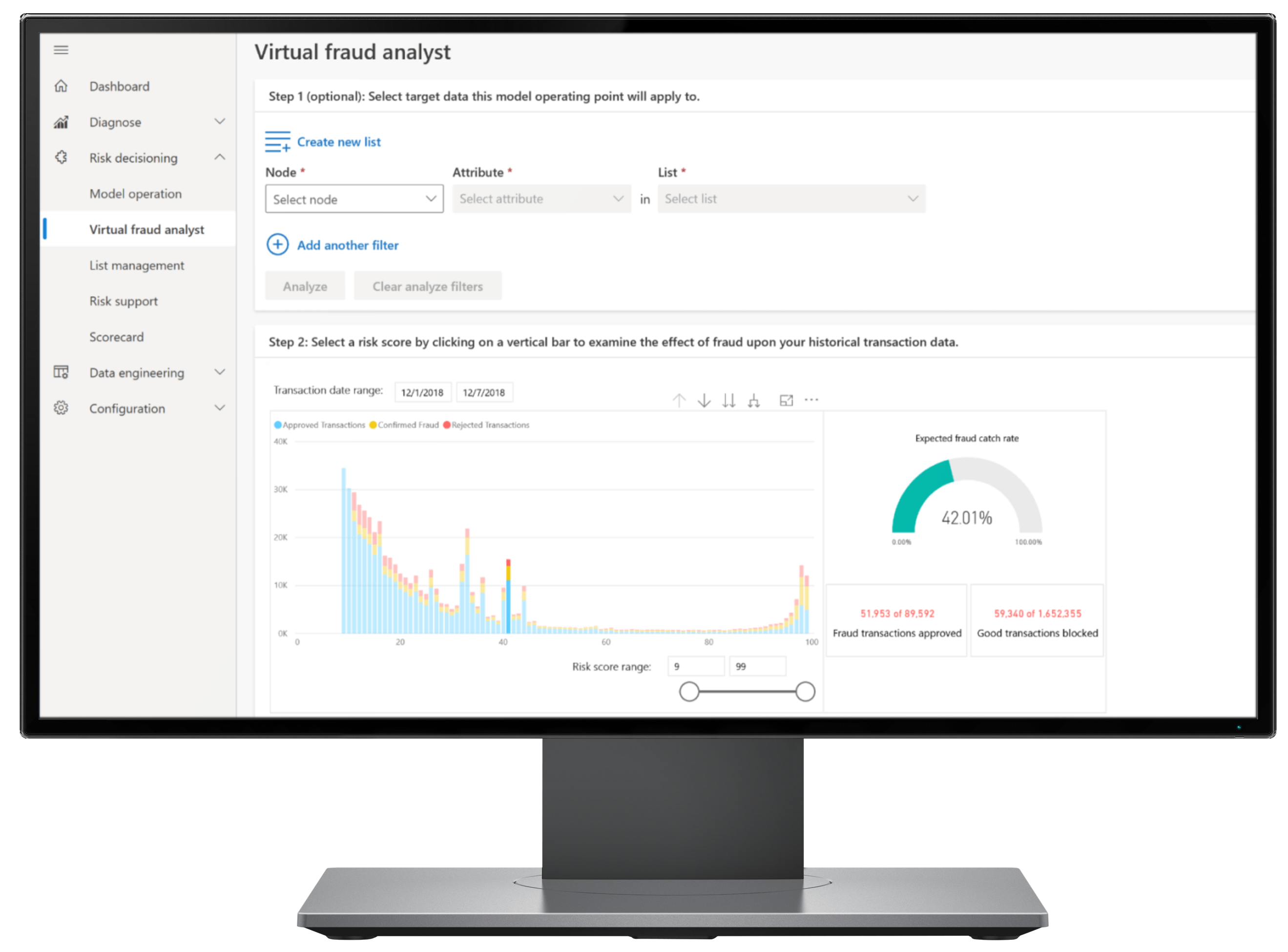

Artificial intelligence helps to maximize profit

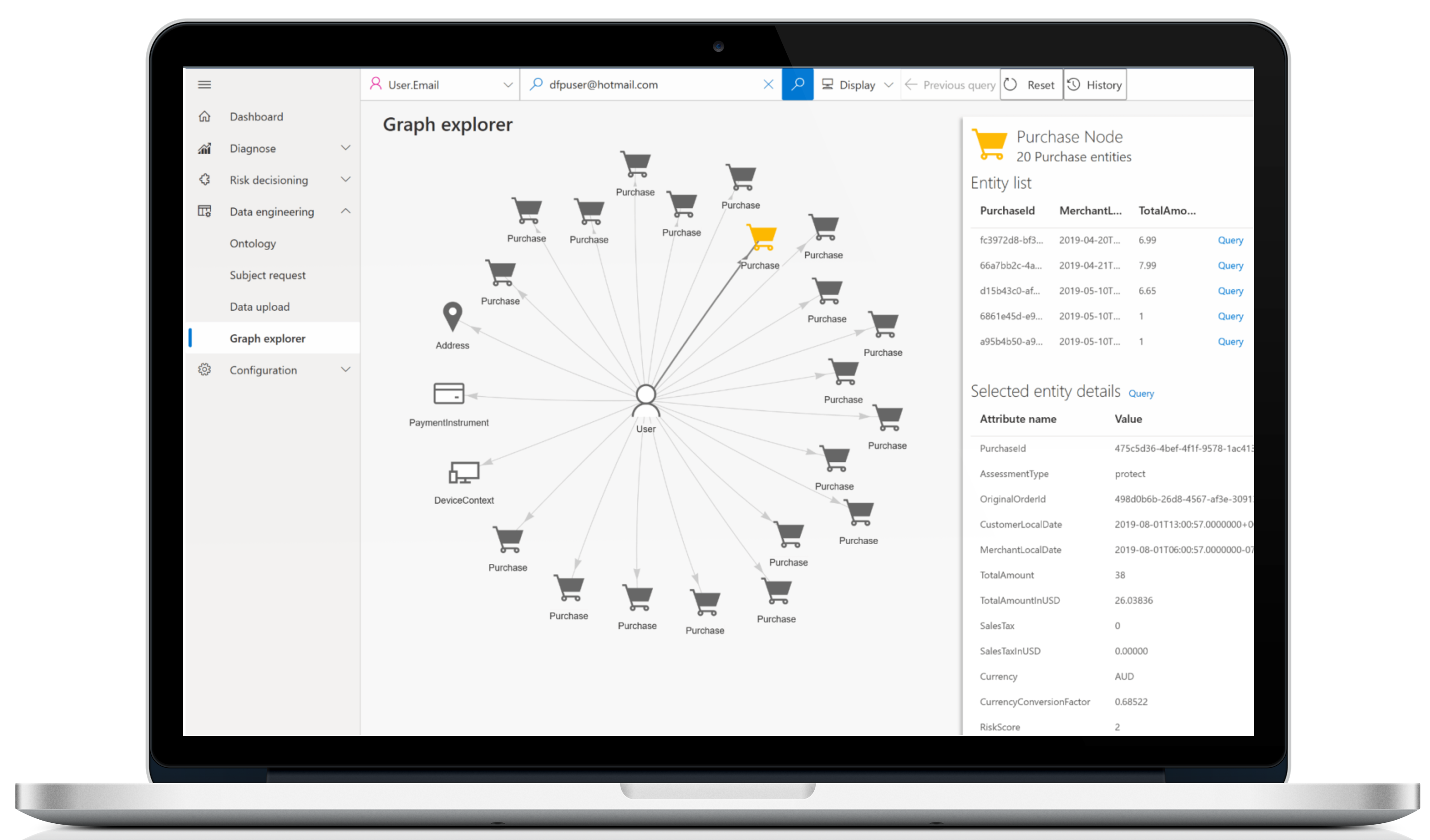

Modern fraud protection cannot be done without artificial intelligence. Take advantage of the industry-leading Microsoft AI platform to assess risks, reduce fraudulent payments and account creation, minimize automated attacks on customer accounts, and decrease fraud related expenses. This adaptive AI technology continuously learns through advanced machine learning and a unique connected knowledge graph. We can set you up quickly so you can monitor transactions and spot fraudulent patterns in real time, then take action — fast.

Connected fraud prevention network

Tap into a collective knowledge graph of fraud activity across the globe with Microsoft's own Fraud Protection Network. Your company and customer information stays secure, but you gain access to valuable, connected knowledge across all merchants in the network, in real time. You can also derive insights from other merchants' experiences, better positioning you to handle emerging fraud vectors and assess whether an incoming purchase transaction should be approved, rejected, or manually reviewed with greater accuracy.

Improve the shopping experience

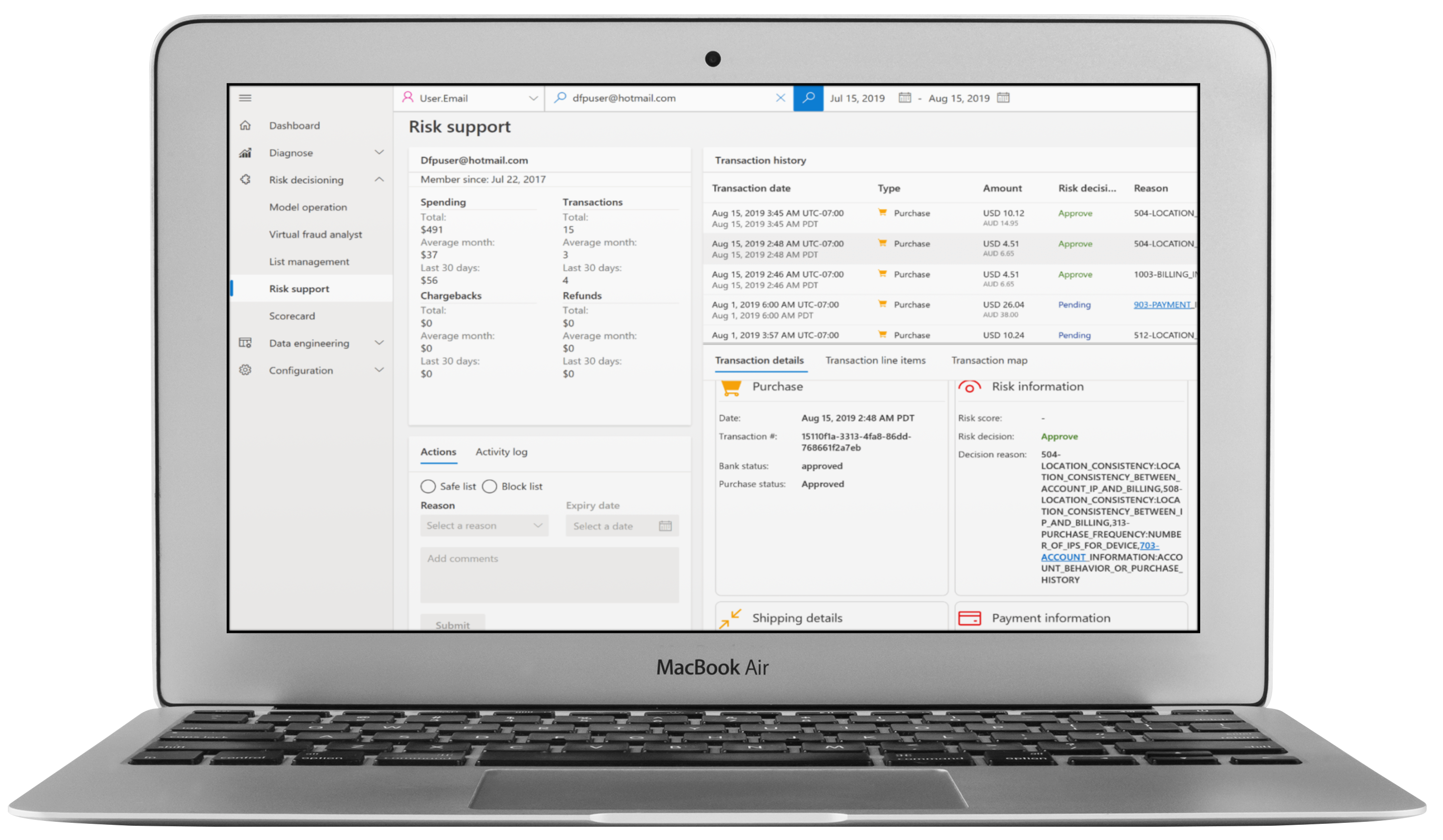

Increase fraud detection accuracy, while decreasing friction for your real customers. The built-in Transaction Acceptance Booster allows you to opt-in to share transactional trust knowledge with issuing banks to boost authorization rates. This increase in bank acceptance and improved customer experience directly correlates with revenue gains. And, in the event of a customer escalation, your support team will be empowered to act quickly. With the Customer Escalation Support Tool, your support team will see detailed risk insights to make decisions fast and unblock legitimate purchase attempts.

MICROSOFT DYNAMICS 365 FRAUD PROTECTION FEATURES

Where most other solutions stop at forensics and risk assessment, Microsoft excels with device fingerprinting and trust knowledge sharing with banks, providing additional contextual information to accept transactions with a higher probability.

- Machine learning of fraud patterns

- Virtual fraud assistant

- Configurable rules engine

- Human supervised learning

- Risk tuning for profit maximization

- Merchant admin portal

- Azure data lake store included

- Fake account creation protection

- Connected Knowledge Graph in Azure

- API for transaction payload

- API for for Device Fingerprinting

- Risk Assessment Score

- Transaction Acceptance Booster

- Real-time trust knowledge shared with bank

- Location anonymization for privacy

- Condensed data for privacy

- Safeguard individual and merchant privacy

- Irreversible hashed tokens

- Irreversible address derivations

- Customer Escalation Support Tool

- Standalone solution

- Integrated with Dynamics 365

- GDPR compliant (search and delete)

- API or data upload

Accelerate Your Journey to a Full Fraud Protection Solution

Data is the cornerstone of good decisions. You can start with one of these three experiences with Dynamics 365 Fraud Protection.

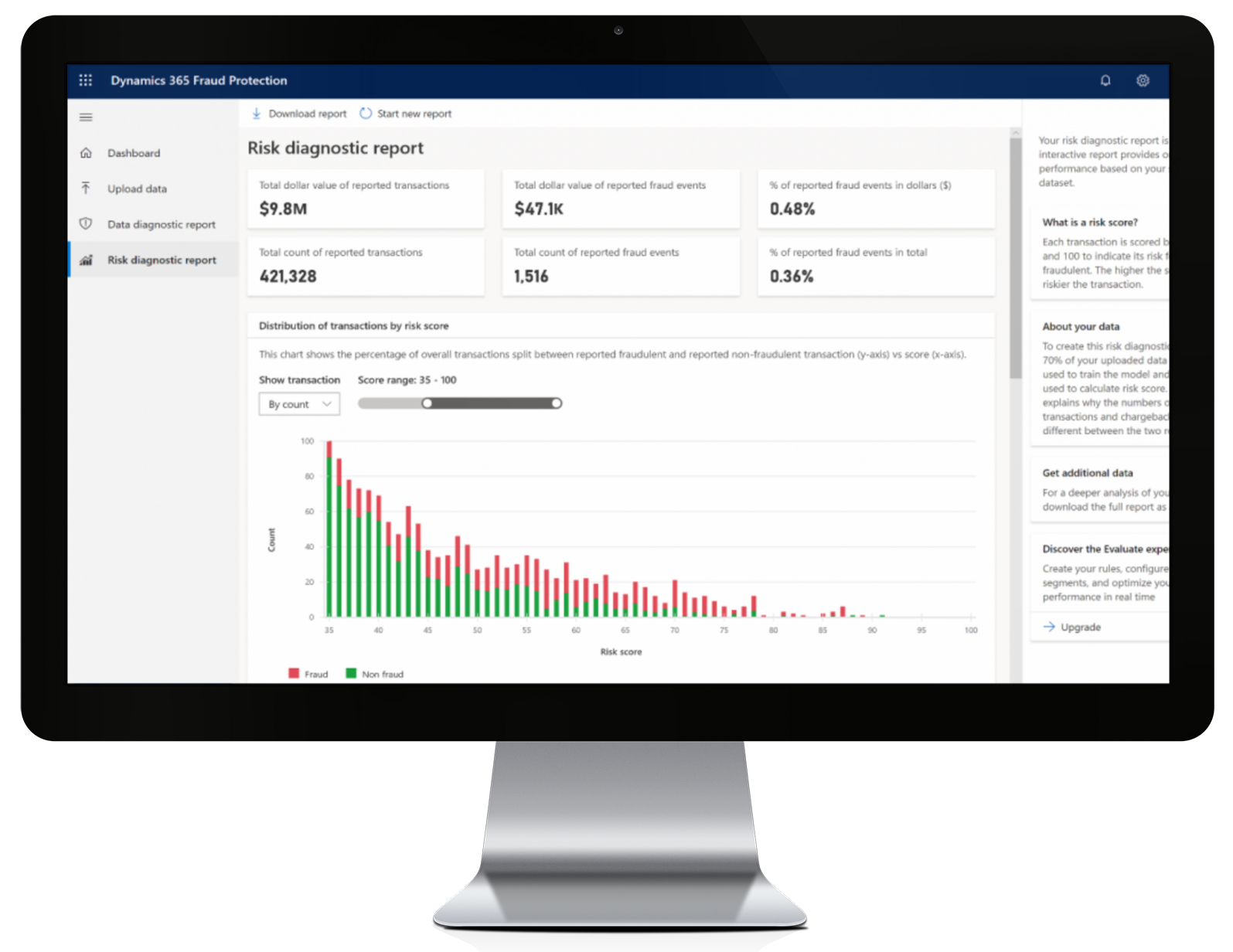

DIAGNOSE

Analyze historical data to gain fraud insights in your current environment.

EVALUATE

PROTECT

Adopt as your primary assessment tool and fully leverage the fraud prevention network and trust knowledge.

DO YOU KNOW HOW MUCH FRAUD IMPACTS YOUR BOTTOM LINE?

Find out with an assessment of your current fraud situation. We can help you quantify the revenue opportunity. Dynamics 365 Fraud Protection can be deployed as a standalone solution or with Finance & Operations to deliver a seamless shopping experience. Contact us today to get started!